Which Outsourced Accounting Services You Should Use?

These tools can be helpful for automatically importing transactions from your bank accounts and payment processors like Stripe. And they generally cost less than hiring expert bookkeepers and accountants. You can be as involved as you prefer, and the right firm will be flexible to specific levels of engagement. Intelligent Finance Operations brings CFOs the […]

These tools can be helpful for automatically importing transactions from your bank accounts and payment processors like Stripe. And they generally cost less than hiring expert bookkeepers and accountants. You can be as involved as you prefer, and the right firm will be flexible to specific levels of engagement. Intelligent Finance Operations brings CFOs the processes and insights they need accounts receivable management best practices to strike this dynamic balance—and the agility to act fast and stay ahead of the business. Using SynOps, we create a data-driven operating model that connects intelligent technologies, talent, and data and analytics to provide real-time, actionable insights. Streamline accounting processes while delivering an excellent customer experience with timely invoices, payments and reports.

Strategic finance operations

Like with a controller, whether or not you’ll need a full accounting service depends on the size of your business. Controllers are more advanced finance professionals that are usually responsible for managing the day-to-day financial operations of a business. They have a wide range of responsibilities, from managing bookkeeping staff to working on more strategic initiatives. But as your business grows and your financial needs evolve, it’s common to find that your initial approach to bookkeeping is no longer delivering the results you need. If that sounds familiar, you might want to consider outsourced bookkeeping.

Payroll Processing

Equally, focus on finding an outsourced CFO that has significant experience navigating the challenges that are currently top of mind for your business. If your main financial goal is to sell your company, make sure margin definition you hire an outsourced CFO that has previously advised on a number of successful transactions. It’s easy to think that the CFO role is a position reserved for larger companies, but that doesn’t have to be the case.

The Role of CPAs and Specialized Accountants in the Construction Industry

- Download our comprehensive research reports, whitepapers, and guides to make better-informed, data-driven decisions.

- The outsourced team already uses advanced software and technology, which allows you to benefit from the latest tools at a fraction of the cost you would incur if you invested in them yourself.

- Additionally, their comprehensive service includes the ability to have prior-year bookkeeping cleaned up.

- Managing non-profit financial statements is very crucial for the operations of non-profit or non-government organizations.

- At first, there may be a lot of work in building the financial infrastructure and accounting services.

Cutting overhead and getting better financial leadership is critical to the success of all companies. By understanding where the industry is currently and where it is moving, you’ll be able to decide whether outsourcing is the right decision for your business. Financial planning and accounting are two critical components of running a successful business. This article will guide you through the concept of outsourced finance and accounting services, discuss the latest trends, and help you understand how to outsource these services. Partnering with an outsourced controller gives businesses many of the same benefits as partnering with an outsourced bookkeeper, but on a more strategic level. Outsourced controllers are experienced accounting professionals who have worked with a diverse range of businesses.

Accounts receivable (AR) and accounts payable (AP) are essential accounting functions for any business. They ensure the timely collection of payments from your customers for products or services sold (AR), and management of the money you owe to vendors (AP). When you outsource, you can leverage the expertise and experience of firms who are already established in those markets. This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified. Focusing on your core competencies is essential for your business’s growth and success.

How AI is impacting the accounting and finance sector

Did you know that the construction industry in the U.S. is home to over 919,000 establishments and employs about 8 million workers? With such a vast sector generating nearly $2.1 trillion annually, managing finances can be a challenge. Do you need complete services to take place at a remote, virtual location?

Today’s finance function is in a unique position to drive positive change for the business. Gone are the days when the CFO’s focus was solely on the transactional aspects of day-to-day accounting processes. But now organizations also expect CFOs to identify and ignite strategic change, so the business grows value profitably and sustainably. External accounting companies will have the most updated knowledge of security procedures and data protection standards. This knowledge is especially important in the current age, with most services and transactions occurring online.

We’ll also give you some key tips and insights into finding a provider and ensuring the process goes smoothly. Access to advanced technology can make your business operations more efficient. The Staff Accountant may be involved with training and overseeing of processors and interns and may have direct contact with the clients they are serving. The work of the Staff Accountant is performed in the Marcum office but may involve travel to client sites.

This leaves outsourcing as an attractive option over full-time house staff. When considering financial services, always keep your business needs in mind. Hiring a finance team from your local talent pool is not always an option because their skills and experience may be limited. However, by outsourcing this job to experts across the globe, you can hire dedicated individuals willing to work long hours just for the opportunity! Many accounting firms have shifted their approach with the rise of customer-centric businesses.

Their expertise helps mitigate financial risks and improve overall financial health, offering tailored solutions for your bookkeeping needs. Accounting services are available to you that provide this level of assistance. FreshBooks offers support from highly knowledgeable help centre staff, along with dedicated account management, advisory services, and connections to expert accountants near you. Freshbooks has advanced tools, including accounting software that gives you 24/7 access to financial data. Are you looking for complete financial service outsourcing, or do you need to outsource specific tasks? What kind of privacy or security measures does your business require (depending on the operations and data that you will share with the outsourced team)?

They recognize that every company has unique needs and customize services accordingly to maximize customer value while avoiding overpayments. A-la-carte techniques allow clients to choose only what they need rather than paying an arm (or leg) upfront. One of the best advantages of working with an outsourced accounting team is that you’ll get access to the most up-to-date accounting software. Several businesses are outsourcing accounting services to fill their company’s needs with the best knowledge and qualifications. As mentioned, one alternative to outsourcing is hiring a full-time employee or assembling an accounting team to handle accounting functions.

Additionally, if you ever have complex issues like back taxes, you can consult a tax attorney for back taxes. This specialized knowledge can prevent costly mistakes and ensure your business stays on the right track. This means you can better manage your budget and allocate funds to other important areas of your business.

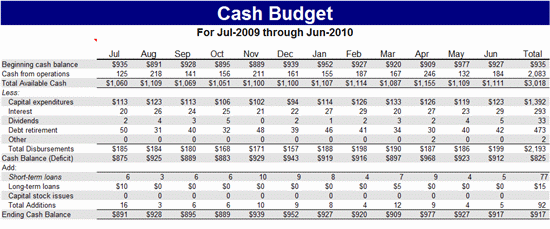

Compare your options and choose a provider that meets your requirements and, of course, your budget. As a result, it’s helpful to understand what you might want to outsource, and what you might want to keep in-house. Your company can easily draw up cash flow projections for the next year, next quarter, or even next week. This lets you see the complete picture regarding the changes that need to be made and when they need to be accomplished. Such projections are also useful for predicting potential slow periods and planning for them in advance. However, you have to use third-party apps with QuickBooks accounts and pay the bills.

They have industry expertise that can help with organising your business and cash flow and provide advice on future financial moves. No matter the size of the business or service you are offering, there will be some degree of financial responsibility that you need to take care of. Using a professional external accountant rather than hiring a part-time or full-time accountant onto your team and potentially can save you thousands per year.

To sum up, outsourcing your accounting and tax services makes many things easier. Compliance assurance is a critical benefit of outsourcing your accounting and tax services. When you outsource, you work with experts prepaid insurance definition who understand the latest laws and regulations. Outsourcing your accounting and tax services offers significant time savings. You do not have to spend hours on bookkeeping or tax preparation services.

Whether you’re a startup aiming to minimize overhead costs or a seasoned enterprise seeking to focus on core competencies, outsourcing finance and accounting offers a myriad of benefits. SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. The decision to subcontract AP involves weighing pros like expense reduction and full payment processing against cons such as loss of control and dependency risks. Take your time to determine your organization’s needs and select a service provider that aligns with your requirements and objectives.

Outsourced payroll services take the burden off your shoulders, ensuring that your employees always receive accurate and on-time payments. This includes calculating wages, deducting the correct amount of taxes, and ensuring compliance with relevant employment and tax laws. The service providers often use sophisticated payroll software, which can handle everything from direct deposits to generating detailed payroll reports. Outsourcing finance and accounting services are an increasingly popular way for companies of all sizes to save money. The process of finding the right outsourcing finance and accounting services provider is not an easy task. However, take your time to consider what criteria will make a good fit for your company and your outsourced partner.

Outsourcing accounting services allows you to focus on core business operations while experts handle financial management. You gain access to professional bookkeepers without the overhead costs of hiring and training in-house staff, saving time and money while ensuring accurate and up-to-date financial records. This resource is essential for small business owners to maximize efficiency. Additionally, outsourced accounting firms can utilize advanced technologies that may be costly for a business to acquire independently.

Quality of work and quality of team members are both equally critical for those considering outsourcing their financial department. If you are unable to find quality workers in your area, then outsourcing might be the only option left for you. Quality is probably the most important factor that drives companies to outsource their financial department. This is a straightforward guide to the chart of accounts—what it is, how to use it, and why it’s so important for your company’s bookkeeping. This can be done for quite a low hourly rate depending on where you’re comfortable outsourcing to. If you want to keep this part of your business closer to home, check for local AR/AP services in your area.

de

de tr

tr fr

fr az

az es

es ru

ru hi

hi ar

ar