Finest CFD Brokers and Trading Platforms

Contracts for Difference, or CFDs, are likely among one of the most popular financial tools as they allow traders to take flexible accessibility to worldwide markets with making use of utilize. CFDs allow supposition in the rate motions of possessions such as supplies, indices, assets, Foreign exchange, and cryptocurrencies without in fact holding the underlying […]

Contracts for Difference, or CFDs, are likely among one of the most popular financial tools as they allow traders to take flexible accessibility to worldwide markets with making use of utilize. CFDs allow supposition in the rate motions of possessions such as supplies, indices, assets, Foreign exchange, and cryptocurrencies without in fact holding the underlying property. Such flexibility, paired with the facility of trading on margin, makes CFDs eye-catching to both retail and professional investors.

Not all brokers are developed equal. Selecting the appropriate CFD broker is important for your trading success because brokers give the system, tools, and sources you will certainly utilize to execute your trades.read about it best cfd brokers from Our Articles A good broker assurances transparent costs, solid innovation, and the capability to trade with the possessions you want. This overview describes what CFDs are, exactly how they work, their advantages and risks, and, most importantly, what to try to find when choosing the very best CFD brokers.

What is the most effective trading platform for CFD trading?

Your trading platform is the most integral part of your CFD trading, as it offers you with the major device for profession execution, market evaluation, and threat management. The very best trading systems for CFDs are those that confirm easy to use interfaces with innovative devices, so both beginners and progressed traders can maximize their trading approaches.

Key features of a suitable CFD trading system

One have to take into consideration speed, dependability, charting, and accessibility to automated trading devices when selecting a CFD system. The highlights one needs are as follows:

- Usability: The platform needs to be easy to use, supplying smooth navigation and clear procedures to be executed.

- Advanced charting and evaluation: Rich charting abilities, many technological indicators, and extremely adjustable formats are important for any kind of market evaluation.

- Rate and stability: A robust system makes sure smooth implementation with low latency also under high market volatility.

- Automation and personalization: Attributes such as algorithmic trading, adjustable user interfaces, and scripting support make it a wonderful trading experience.

Leading trading systems for CFD trading

Below is a closer check out several of the very best systems for CFD trading.

MetaTrader (MT4 and MT5)

The most-used CFD trading systems are MetaTrader 4 and MetaTrader 5. They include full-featured charting capacities, support for automated trading by means of Expert Advisors (EAs), and a wide accessibility amongst brokers worldwide.

MT4 is perfect for investors of Forex and CFDs that look for simpleness and stability. It has a lot of technological signs and a very straightforward user interface. MT5, on the other hand, is a sophisticated variation of MT4 and sustains multi-asset trading, more time frames, and extra technical devices. It is better for investors that need access to a diverse range of properties, consisting of stocks and commodities.

MetaTrader is especially prominent with investors that appreciate customizability as it enables users to produce and execute their own trading methods by means of scripting.

TradingView

TradingView is a web-based platform that is widely valued by CFD investors thanks to its lovely user interface, strong charting tools, and social trading functions. It uses huge technical evaluation devices, social interaction with other traders, and even the creation of personalized indications.

While TradingView does not implement professions itself, it is well-integrated with a lots of brokers, permitting CFD traders to utilize its charts while taking care of trades with their broker’s system.

ProRealTime

ProRealTime is a professional-level trading system created for advanced traders seeking sophisticated charting and evaluation devices. It is popular amongst technological analysts and day traders.

It has an effective backtesting engine, real-time information, and a large variety of attracting and evaluation tools. It likewise supports computerized trading.

The system is subscription-based, with premium functions offered for those needing institutional-grade tools.

cTrader

cTrader is a very modern-day, extremely customizable trading system with an user-friendly style and advanced order implementation abilities. It permits in-depth profession analytics, with algorithmic trading assistance.

cTrader likewise has good combination with lots of brokers and is a fantastic system for any kind of trader searching for a specialist trading-oriented system.

Selecting the ideal platform to fit your requirements

If youre a novice or choose an internationally recognized system with comprehensive sources, MetaTrader (MT4 or MT5) is a superb selection.

- For those investors depending a lot on charting and requiring accessibility to neighborhood understandings, TradingView is the means to go.

- Advanced investors that require accuracy in technical analysis and backtesting will like the functions offered by ProRealTime.

- Those investors looking for a modern-day, effective platform with advanced execution tools need to check cTrader.

What is the minimum deposit for trading CFDs?

The minimal deposit to trade CFDs depends on the broker and likewise on the kind of account. On the internet brokers normally have reduced minimum down payments, commonly as low as $100. Hence, CFDs are fairly accessible to retail investors.

Greater deposits, nevertheless, in the variety from $1,000 to $10,000, may open costs accounts with a few more benefits, such as tighter spreads, concern client assistance, and advanced devices.

Starting with the minimum deposit can be an excellent way to examine the waters for novices, yet make certain you have adequate funds to deal with margin requirements and avoid over-leveraging.

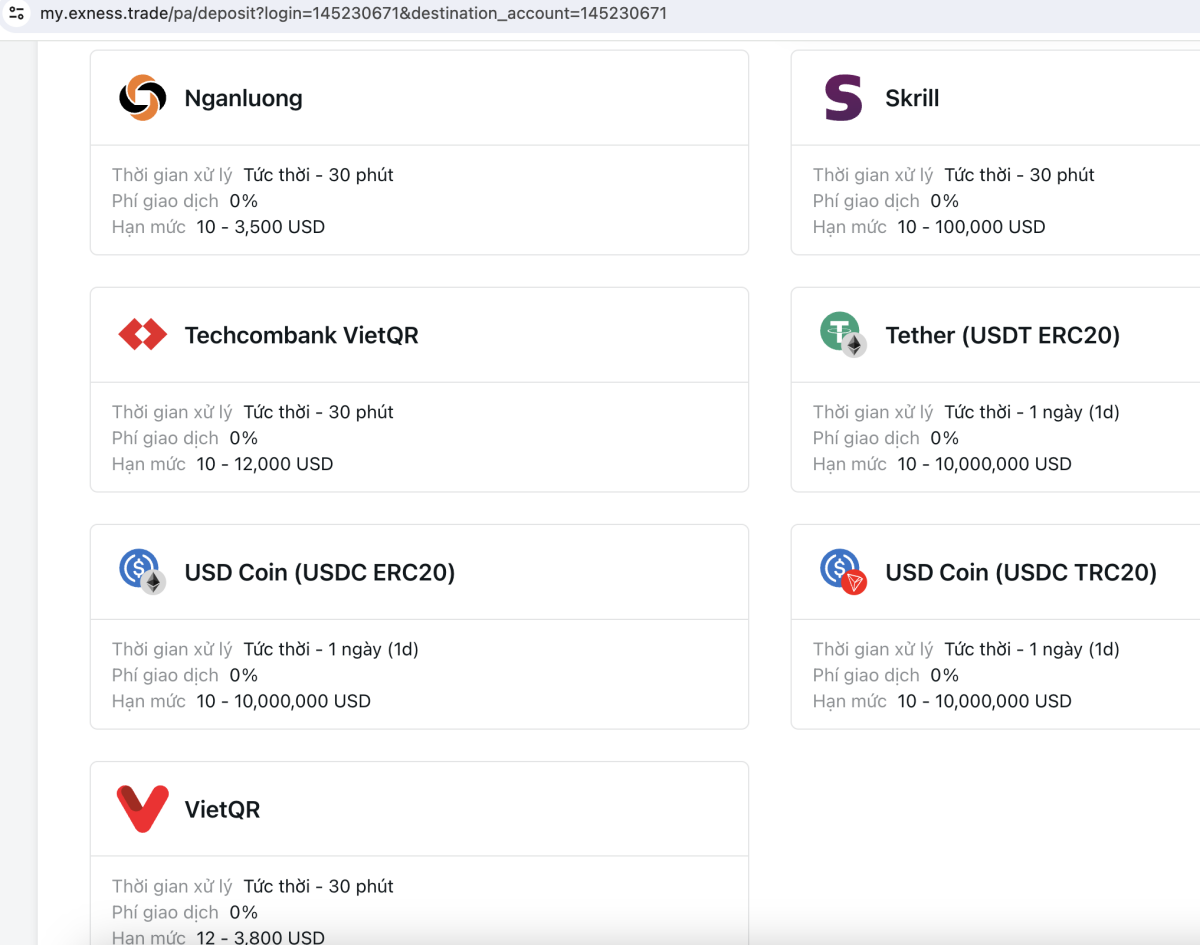

Many brokers enable down payments by different ways, consisting of financial institution transfers, credit/debit cards, and e-wallets. The selected broker needs to support your favored repayment system, and check whether there are some charges associated with transferring, but despite having the withdrawal procedure.

Just how to choose a CFD broker?

Of all the decisions a trader has to make, the most essential is most definitely selecting the appropriate CFD broker. The broker you choose will directly influence your trading experience, prices, and inevitably your productivity.

There are just so lots of choices, and it’s excellent to know what you need to look for in a CFD broker so that you trade in the most safe, cost-efficient, and efficient atmosphere feasible. Please go through the adhering to comprehensive overview on how to deal with it.

Conclusion

CFD trading is a powerful means to enter global markets with unrivaled adaptability and profit potential. Nevertheless, its leveraged nature calls for careful planning, solid threat management, and a deep understanding of market characteristics.

Making a major option for CFD traders is selecting the appropriate broker. A great broker ought to have competitive prices, access to a wide array of markets, a reliable platform, and solid consumer assistance. Bear in mind to maintain guideline, transparency, and alignment with your trading goals at the very leading of your priority list as you look for a CFD broker.

Finest CFD Brokers and Trading Platforms |

de

de tr

tr fr

fr az

az es

es ru

ru hi

hi ar

ar