Mastering the Market Best Candlestick Patterns for Binary Trading

The Best Candlestick Patterns for Binary Trading In the world of trading, understanding market movements is crucial for success. One of the most effective ways to analyze price movements is through candlestick patterns. These patterns provide insights into market sentiment and can be used to predict future price movements. In this article, we will explore […]

The Best Candlestick Patterns for Binary Trading

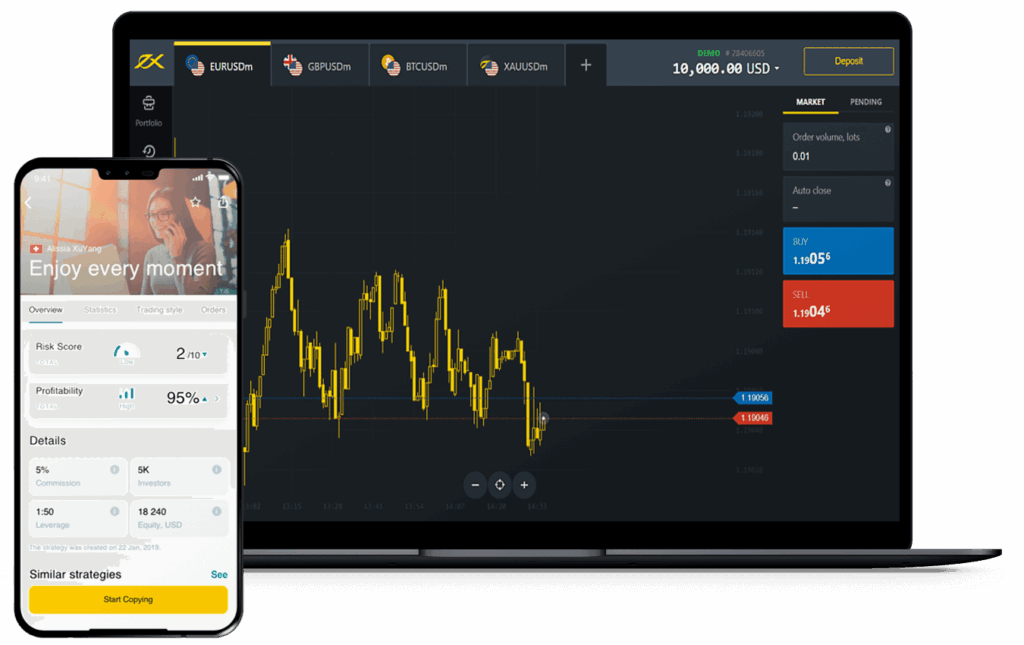

In the world of trading, understanding market movements is crucial for success. One of the most effective ways to analyze price movements is through candlestick patterns. These patterns provide insights into market sentiment and can be used to predict future price movements. In this article, we will explore the best candlestick patterns for binary options best binary options candlestick patterns that traders can utilize for binary trading.

What Are Candlestick Patterns?

Candlestick patterns are graphical representations of price movements over a specific period. Each candlestick provides information on the open, close, high, and low prices during that period. The shape and color of the candlestick can indicate whether the price moved up or down, as well as the strength of that movement.

A candlestick consists of a body and wicks (or shadows). The body represents the range between the open and close prices, while the wicks show the highs and lows during that period. By analyzing these patterns, traders can gain valuable insights into market trends and potential reversals.

Why Use Candlestick Patterns in Binary Trading?

Candlestick patterns are particularly useful in binary trading for several reasons:

- Quick Analysis: Candlestick patterns allow traders to quickly assess market conditions and make decisions.

- Visual Representation: The visual nature of candlesticks makes it easier to identify trends and reversals compared to traditional line charts.

- Psychological Insights: Candlestick patterns reflect market psychology, giving traders insight into the emotions driving price movements.

Top Candlestick Patterns for Binary Trading

1. Doji

The Doji is a candlestick pattern that indicates indecision in the market. It forms when the open and close prices are nearly the same, resulting in a small body with long wicks. Traders interpret a Doji as a potential reversal signal. If it appears after a strong upward or downward trend, it may indicate that the trend is losing momentum.

2. Hammer and Hanging Man

The Hammer and Hanging Man patterns have similar shapes but indicate different market sentiments. The Hammer appears after a downtrend and signals a potential reversal to the upside. It has a small body at the top of the price range with a long wick below. Conversely, the Hanging Man appears after an uptrend and may indicate a reversal to the downside.

3. Engulfing Pattern

The Engulfing Pattern consists of two candles. A bullish engulfing pattern forms when a smaller bearish candle is followed by a larger bullish candle that completely engulfs it. This suggests a potential upward reversal. The bearish engulfing pattern is the opposite and indicates a possible downward reversal.

4. Morning Star and Evening Star

The Morning Star pattern is a bullish reversal indicator that consists of three candles: a bearish candlestick, a small-bodied candlestick, and a bullish candlestick. Conversely, the Evening Star is a bearish reversal pattern, formed by a bullish candlestick followed by a small-bodied candle and a bearish candlestick.

5. Shooting Star

The Shooting Star is a bearish reversal pattern that forms after an uptrend. It has a small body near the low of the price range and a long upper wick, indicating that buyers pushed the price higher, but sellers stepped in to bring it down. This pattern suggests potential weakness in the market.

6. Bullish and Bearish Patterns

Beyond the common candlestick patterns mentioned, various other forms exist that traders might encounter, such as the Bullish and Bearish Flag patterns. These are continuation patterns that indicate the market will likely continue in the direction of the prevailing trend after a brief consolidation phase.

How to Use Candlestick Patterns in Binary Trading

To effectively use candlestick patterns in binary trading, follow these guidelines:

- Combine Patterns: Use multiple candlestick patterns to confirm signals. Relying on just one pattern may lead to false signals.

- Consider Timeframes: Different timeframes can yield different signals. Ensure that you are analyzing the right timeframe for your trading strategy.

- Use with Indicators: Combine candlestick patterns with technical indicators, such as moving averages or RSI, to enhance your analysis.

- Practice Risk Management: Always implement proper risk management strategies. Even the most reliable patterns can lead to losses.

Conclusion

Candlestick patterns are a powerful tool for binary traders. By understanding and recognizing these patterns, traders can make more informed decisions and increase their chances of success in the market. Remember to combine candlestick analysis with other indicators and risk management strategies for the best results. Practice and experience will enhance your ability to interpret these patterns effectively and lead to more profitable trading ventures in the world of binary options.

de

de tr

tr fr

fr az

az es

es ru

ru hi

hi ar

ar